Introduction

Fibonacci is probably the most famous tool for traders. In this article, we will explain its origin, how the more common levels are calculated, and how to use retracements and extension tools.

The Fibonacci sequence was discovered and developed by the Italian mathematician Leonardo Pisano “Fibonacci” (son of Bonaci Pisano). The Fibonacci Sequence, published in the year 1202 in his book “Liber Abaci” (Book of Calculus), exposes the problem of growth of a population of rabbits based on specific assumptions. Fibonacci concluded that each month the density of rabbit pairs was increasing from 1 to 2, then from 2 to 3, the next month from 3 to 5 and so on to infinity. In mathematical terms, the Fibonacci Sequence is:

In practical terms, the Fibonacci Sequence is:

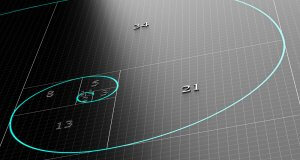

Now that we have calculated the sequence, we will determine the proportions that are related to this number series. In the first place, we will calculate the “Golden Ratio” or Phi (Φ) = 1.61803 and its inverse phi (1/Φ = φ) = 0.61803. Brown (2008) defines the Golden Ratio as a universal law that explains how everything with a growth and decay cycle evolves. In Table 2, we can see how the Fibonacci sequence converges to ratios 1.618 and 0.618; this can also be seen graphically in Figure 1.

Fig 1: 1.618 and 0.618 Convergence (Source: Personal collection)

Fibonacci Levels Formation

Before calculating the various levels of Fibonacci, it is necessary to expose the concepts of retracement and projection. In figure 2, the US Dollar Index <DOLLAR> began a bearish movement on the 3rd of January 2017, registering a maximum level of 103,785, this move recorded a minimum lower than the previous minimum (99,465), after having reached 99,195 on the 2nd of February 2017, going back to 102,270. Once it reached this level, a new bearish cycle began with a projection that reached 90.985. This example is analogous to the bullish case.

Fig 2: Retracement and Projection Movements. (source: Personal Collection)

Using the levels Phi Φ (1.618) and phi φ (0.618), we will calculate the different Fibonacci levels, as follows in Table 3:

Some traders prefer to use the level 0.764 and not 78.6, and vice-versa; this is not a critical factor for analysis and trading, the relevant factor is the decision that could take place when the price reaches this zone. Additionally, it is usual to add some levels in projections, for example, 227.2, 238.2, 3, 327.2, and so on.

Considering the example of the US Dollar Index, in figure 3 the DOLLAR finds resistance at 61.8 level (102.032), where the new bearish cycle takes place in continuation. We do not consider the F(61.8) as a per se rule strictly, sometimes the price finds resistance (or support) on another Fibonacci level, it is essential to follow what the price action is doing.

Fig 2: Fibonacci Retracement (source: Personal Collection)

Once we have continuation signals, using the Fibonacci extension tool, we can define a forecast of the price movement target. In figure 4, DOLLAR follows in the bearish direction, the first objective expected is FE(100), FE(161.8) as the second target and third target FE(200). In our example, the Dollar targets are FE(100) 97.672, FE(161.8) 94.83 and finally FE(200) 93.074.

Fig 4: Fibonacci Extension. (source: Personal Collection)

Notes:

- F(61.8) means 61.8 Fibonacci Retracement Level.

- FE(161.8) means 161.8 Fibonacci Extension Level.

SUGGESTED READINGS:

- Brown, C., (2008). Fibonacci Analysis. New York: Bloomberg Press.

- Carney, S., (2010). Harmonic Trading Volume 1. New Jersey: Pearson Education Ltd.

KEYWORDS:

Fibonacci, Theory, Retracement, Extension.

©Forex.Academy