Introduction

The exponential moving average (EMA) is a specialized chart indicator that tracks the value of an asset over time. It is a sort of weighted moving average (WMA) that provides more weighting or significance to ongoing valuable information. As like the simple moving average, the exponential moving average is utilized to see value patterns over time, and observing a few EMAs at one time is simple to do with moving normal rebinds.

What Is an Exponential Moving Average (EMA)?

An exponential moving normal (EMA) is a kind of moving average (MA) that puts a more noteworthy weight and sharpness on the latest information points. The exponential moving average is likewise alluded to as the exponentially weighted moving average. An exponentially weighted moving average responds more essentially to ongoing value changes than a straightforward moving average (SMA), which applies an equivalent weight to all observations in the period.

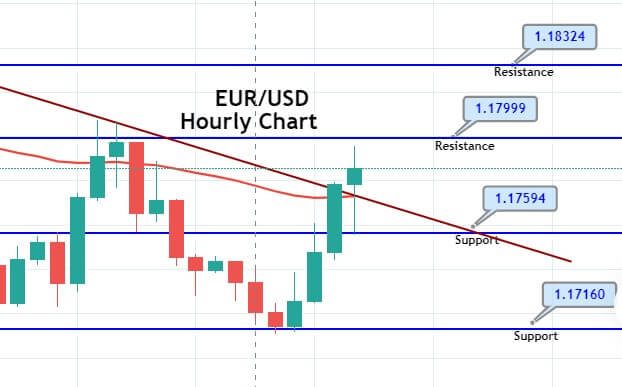

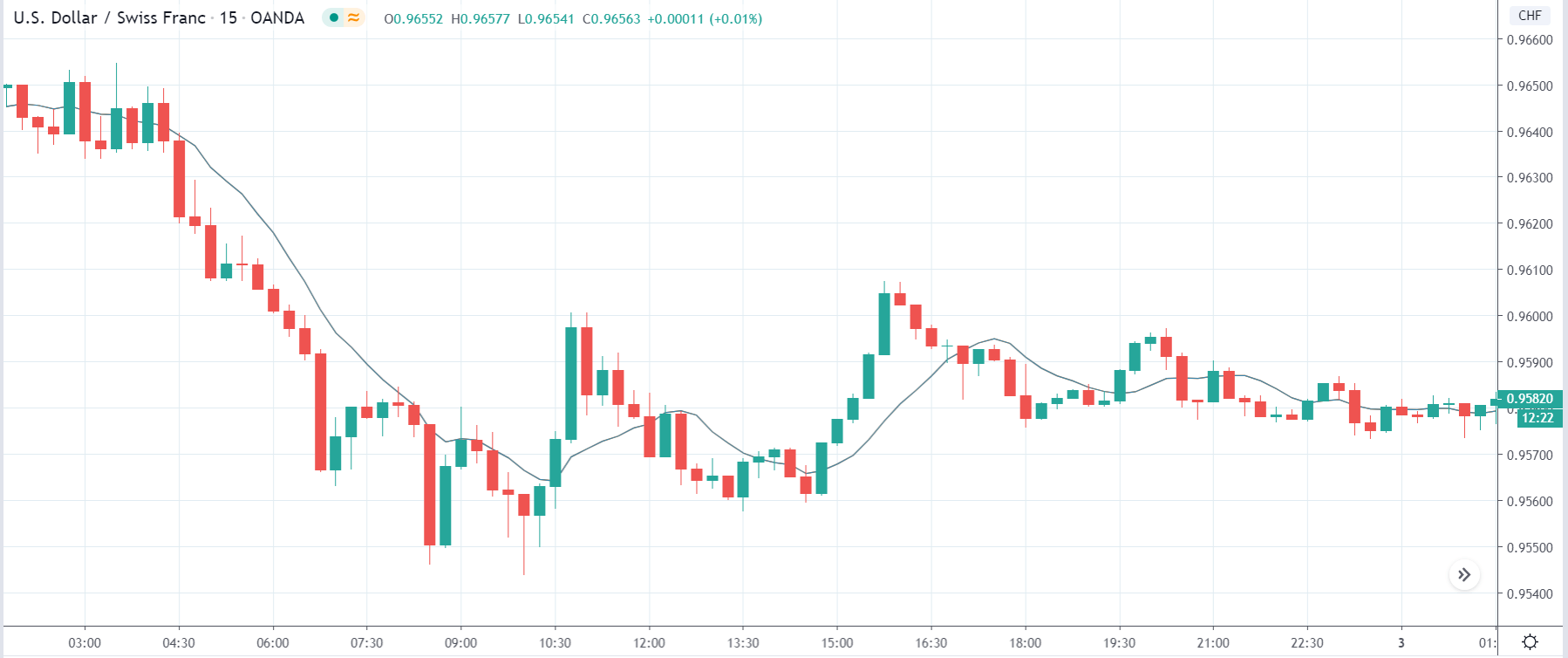

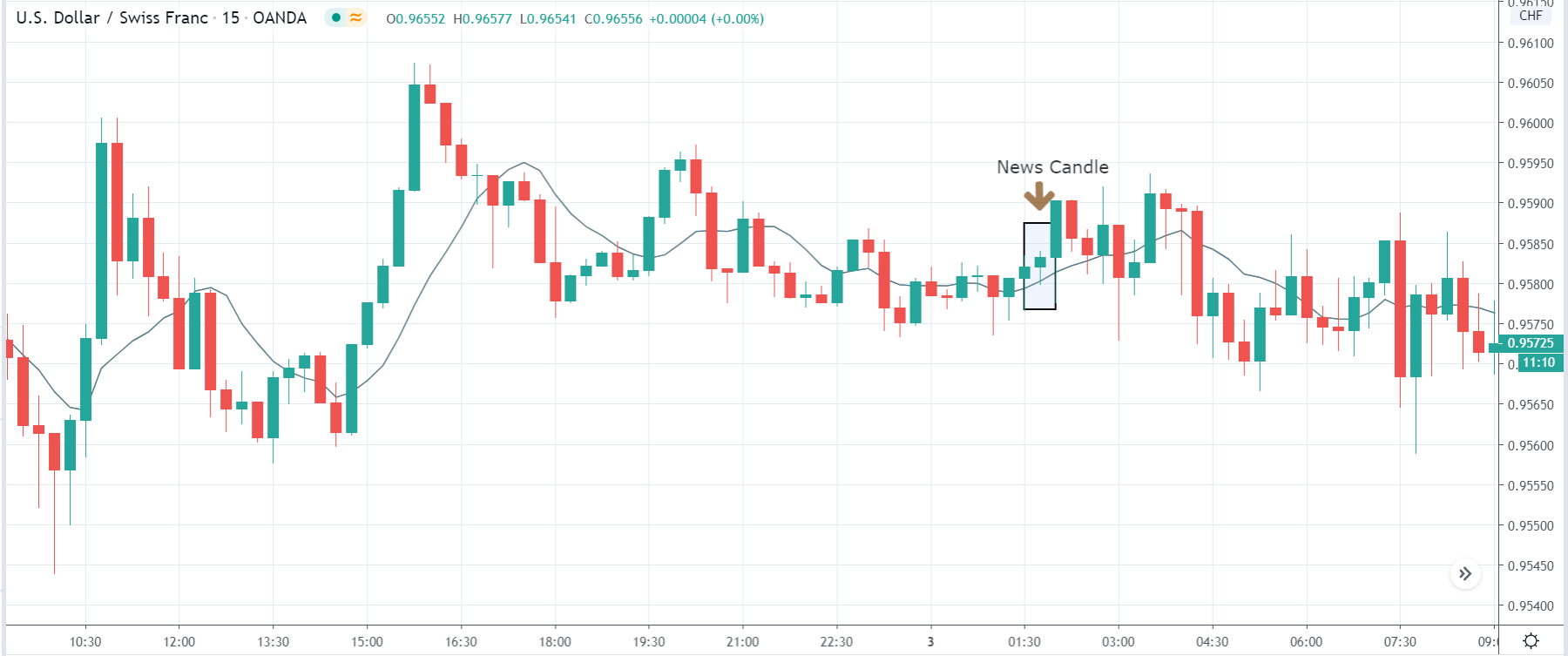

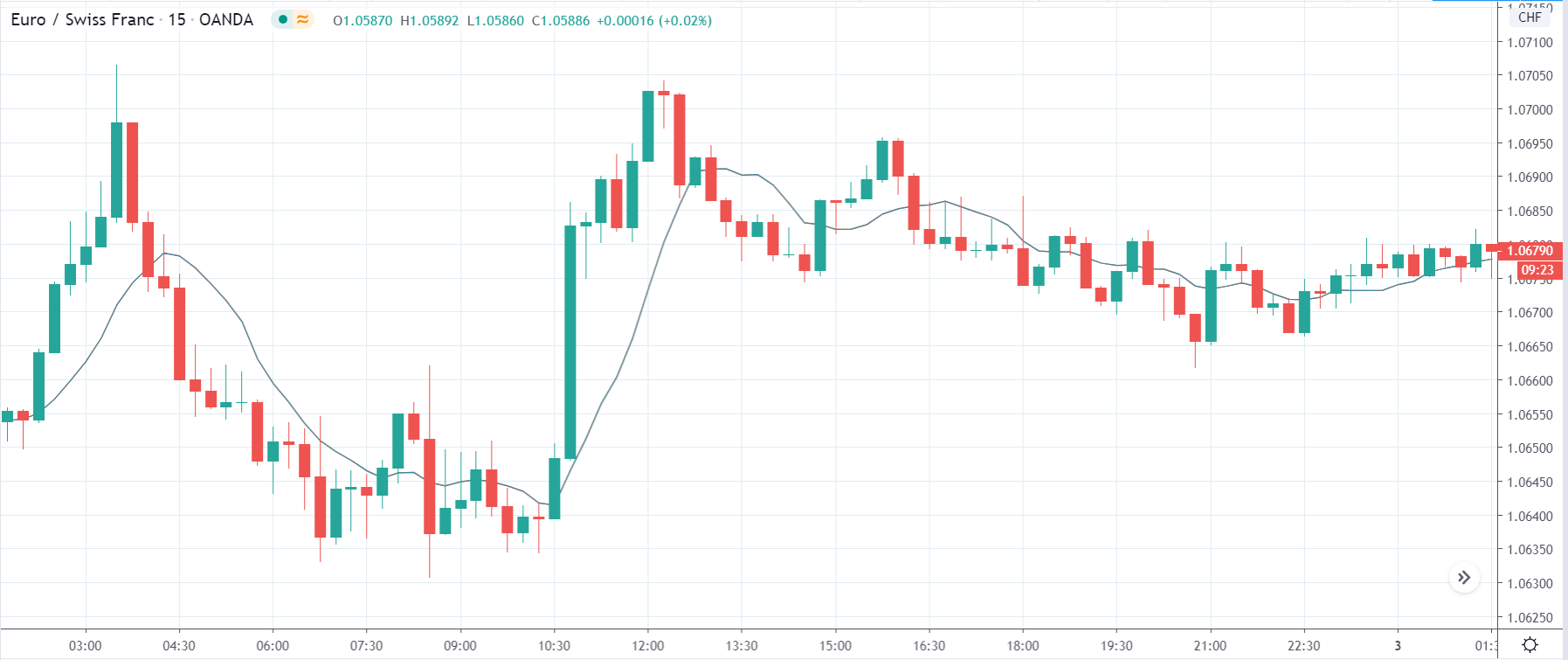

In the below image, you can see a naked chart of EURUSD

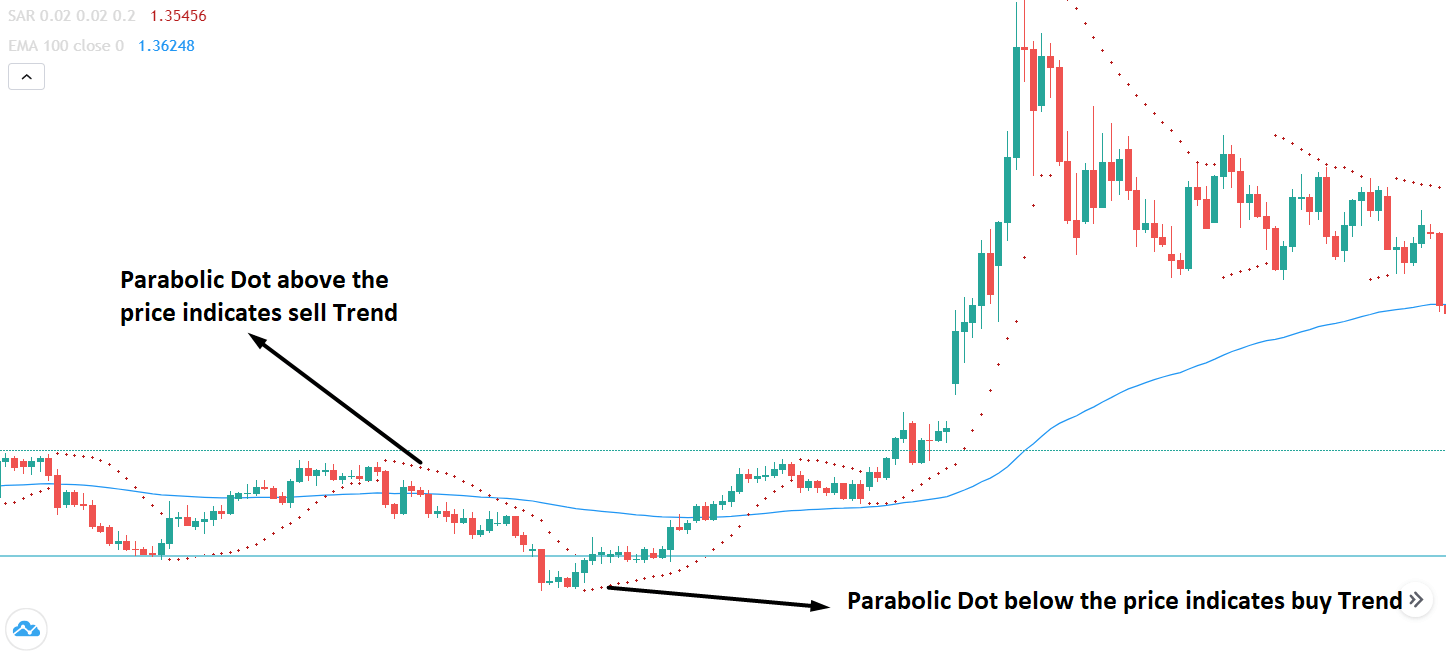

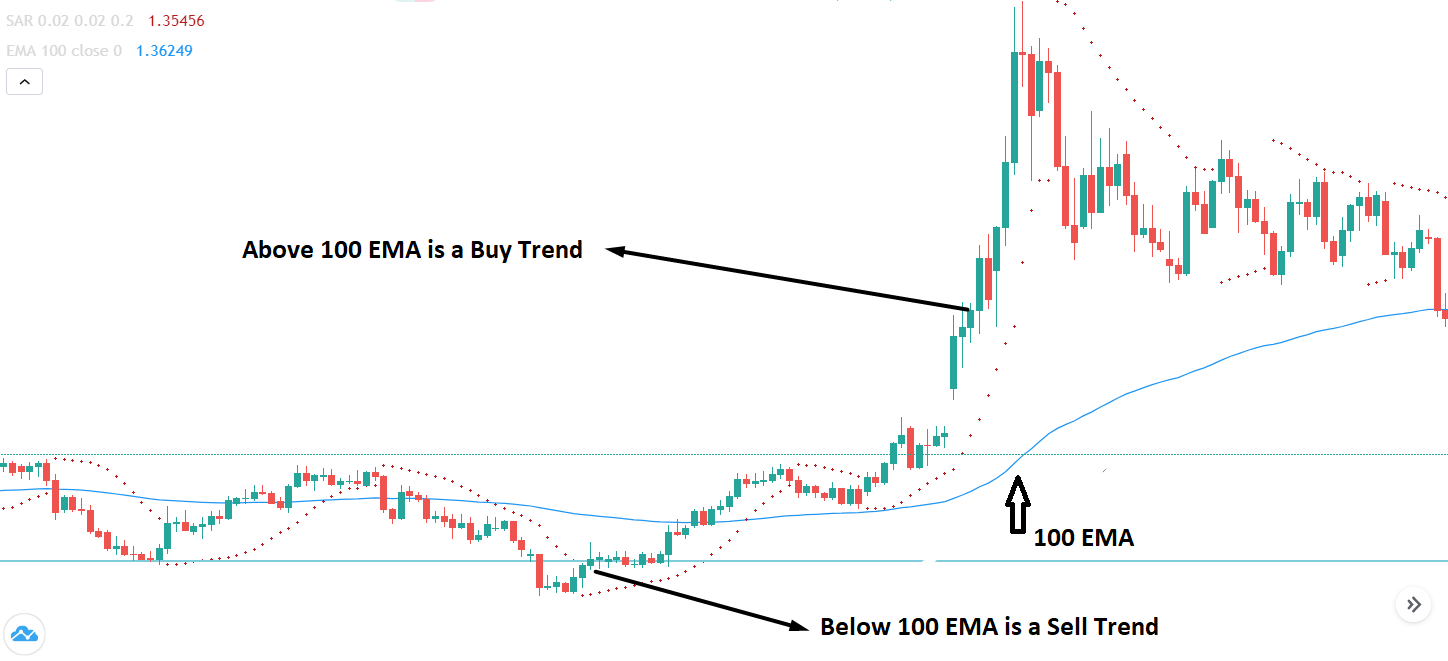

Now let’s plot the exponential moving average in the chart to see how it looks like

The Formula of Exponential Moving Average (EMA)

EMAToday =

(ValuetToday ∗ (Smoothing / 1+Days)) + EMAyesterday * (1 - (Smoothing / 1+Days))

Where: EMA = Exponential Moving Average

While there are numerous potential choices for the smoothing factor, the most widely recognised choice is 2

That gives the latest observation exceeding weight. In the event that the smoothing factor is expanded, later observations have more effect on the EMA.

Calculating the EMA

Calculating the EMA needs one more inspection than the SMA. Assume that you need to utilise 34 days as the number of inspections for the EMA. At that point, you should hold up until the 34th day to gain the SMA. On the 35th day, you would then be able to utilise the SMA from the earlier day as the first EMA for yesterday.

The calculation for the SMA is clear. It is essentially the entirety of the stock’s closing prices during a time span, divided by the number of inspections for that period. For instance, a 34-day SMA is only the entirety of the closing value for the previous 34 trading days, parted by 34.

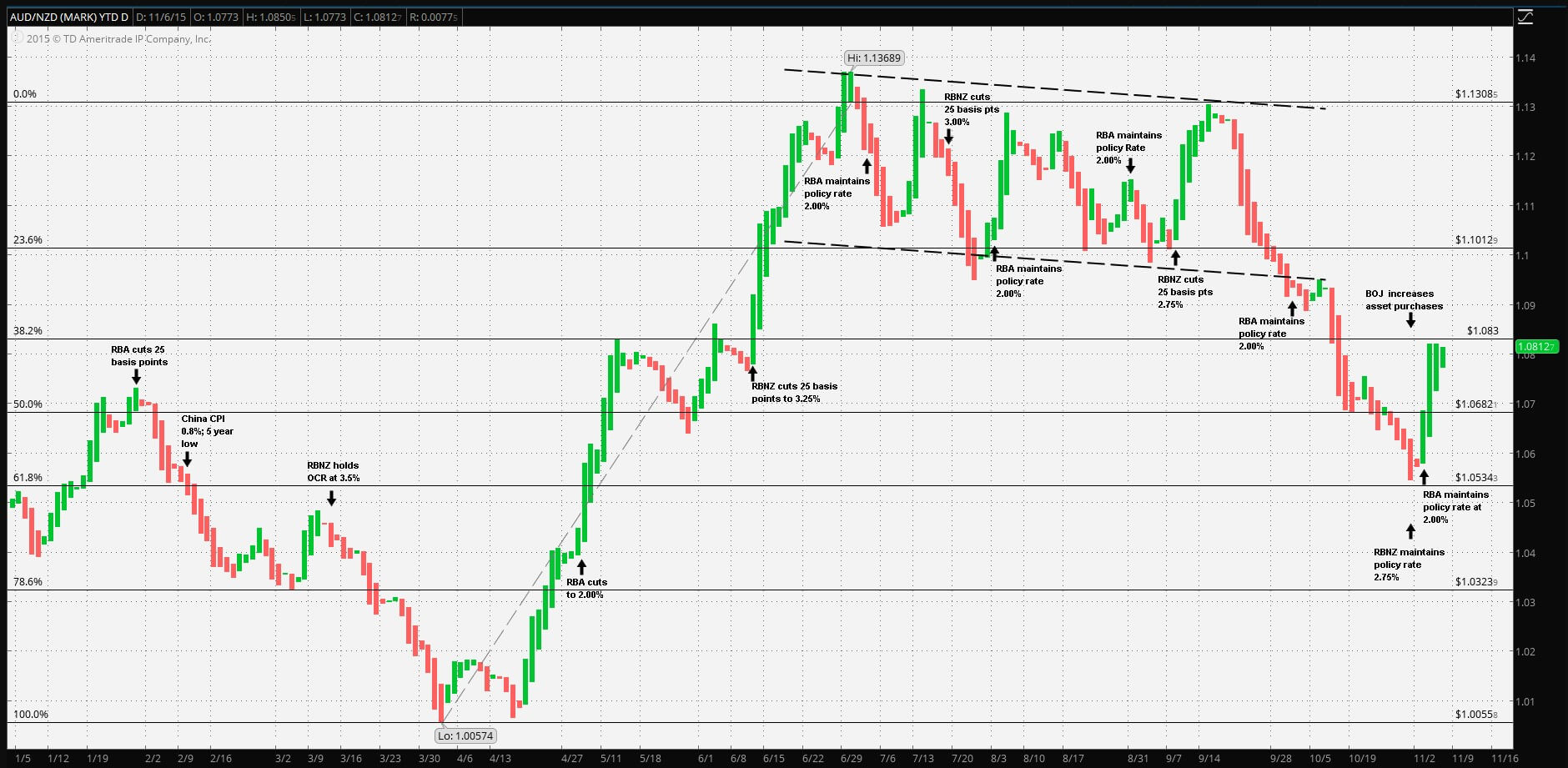

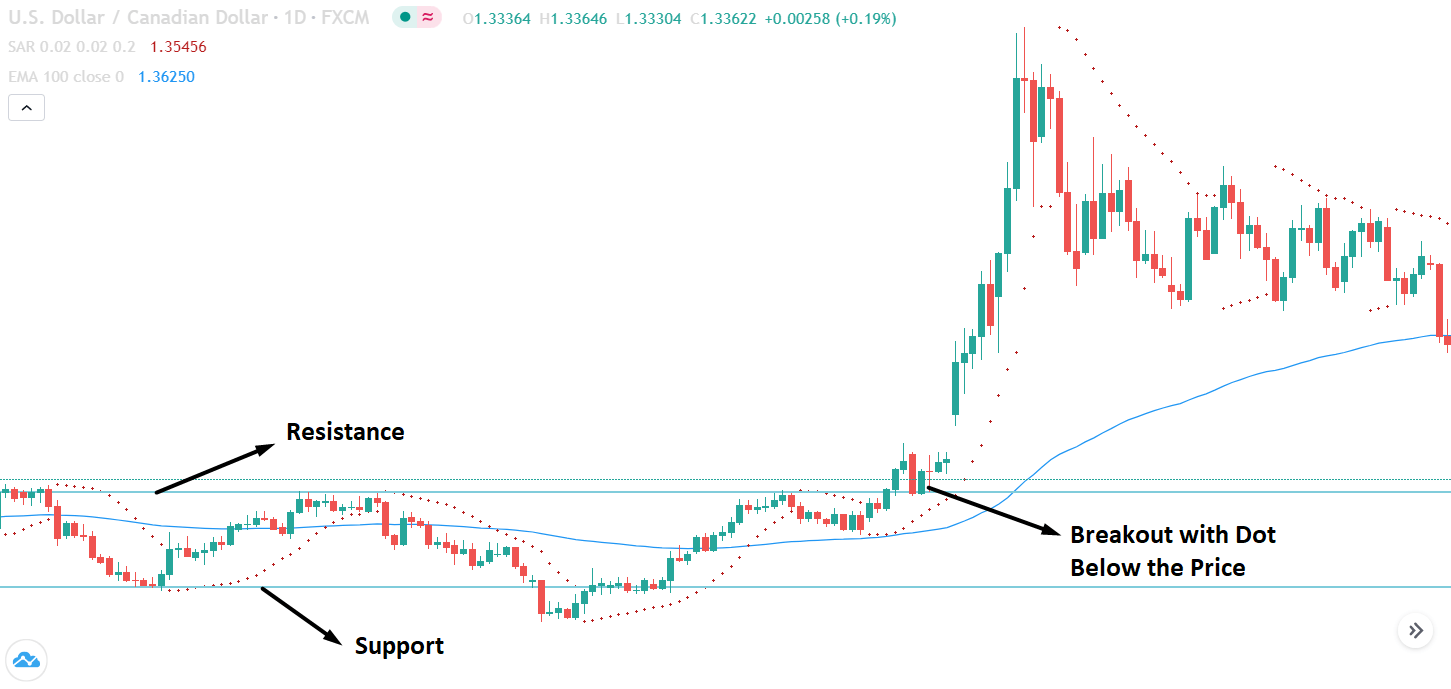

34 EMA with Trendline Breakout Strategy

By combining the exponential moving average indicator with the price action context, the 34 EMA with trend line breakout forex trading strategy has established. In a decent trending market, this forex trading system is an entirely dependable trading strategy that can pull in plenty of pips effectively into your forex trading account.

To demonstrate it, simply proceed to do a little backtest on previous price history, and you will perceive what I’m discussing after you’ve learnt the trading methods and layouts which are additionally clarified underneath.

Timeframes

The 34 exponential moving average trading technique functions admirably in all timeframes from 5 minutes to weekly charts. The higher time frames can give better trading outcomes. However, it is best to stay on the 1 hour to daily chart as it can give high accuracy trades.

Currency Pair

There are no rules to utilise a currency pair. Still, it is good to utilize a forex pair that often remains in the range, for instance, EURUSD. However, all major and minor forex pairs are free to go with this trading technique.

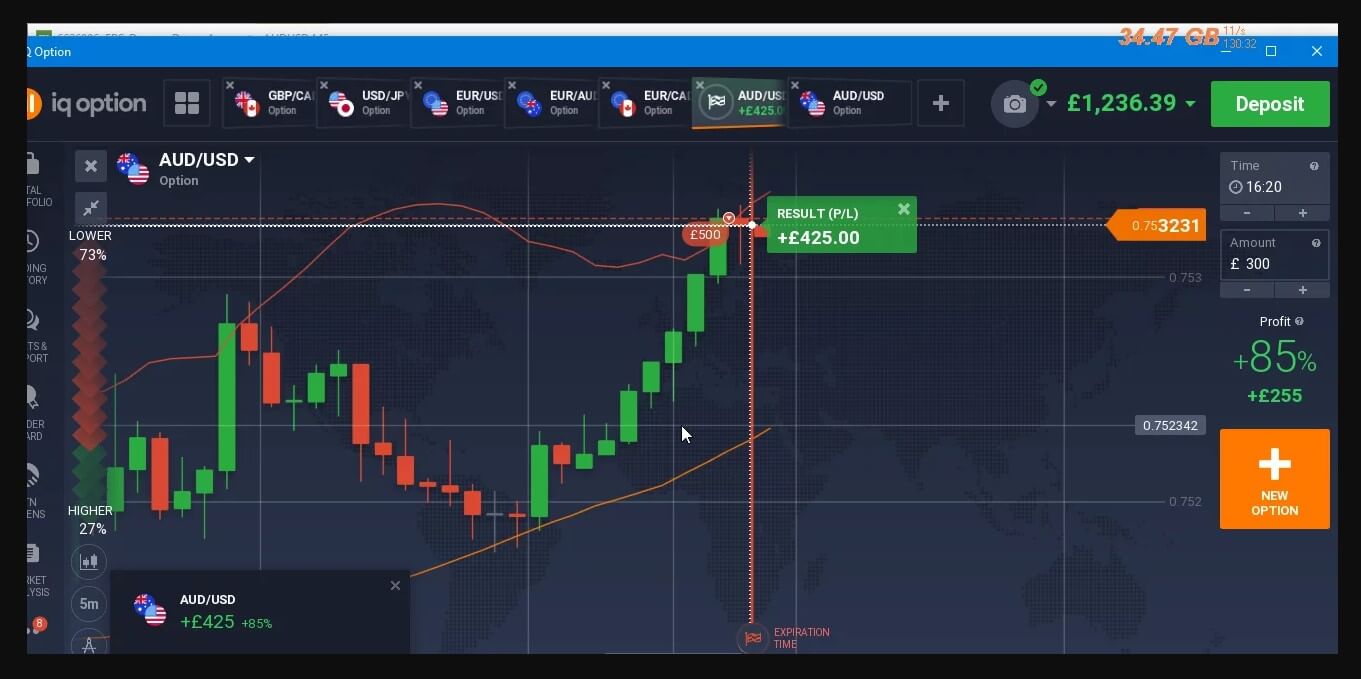

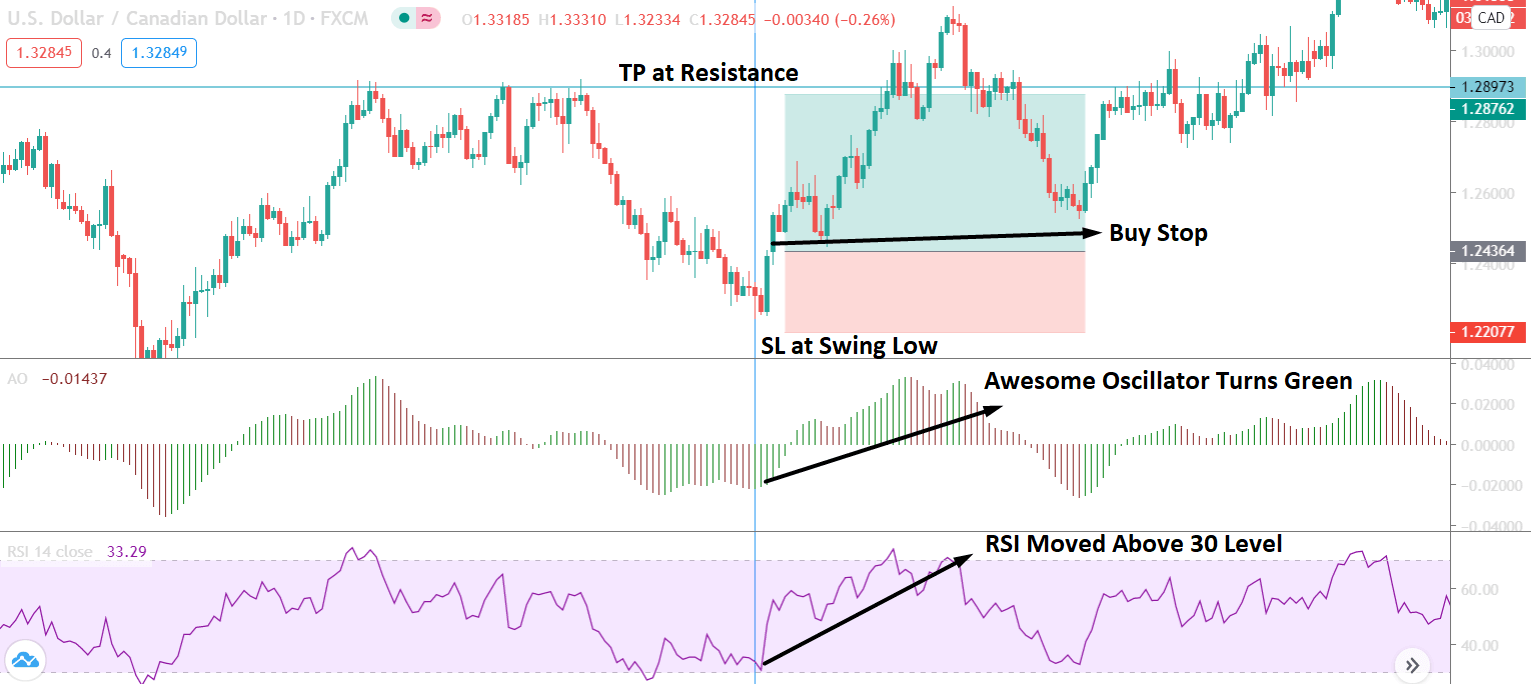

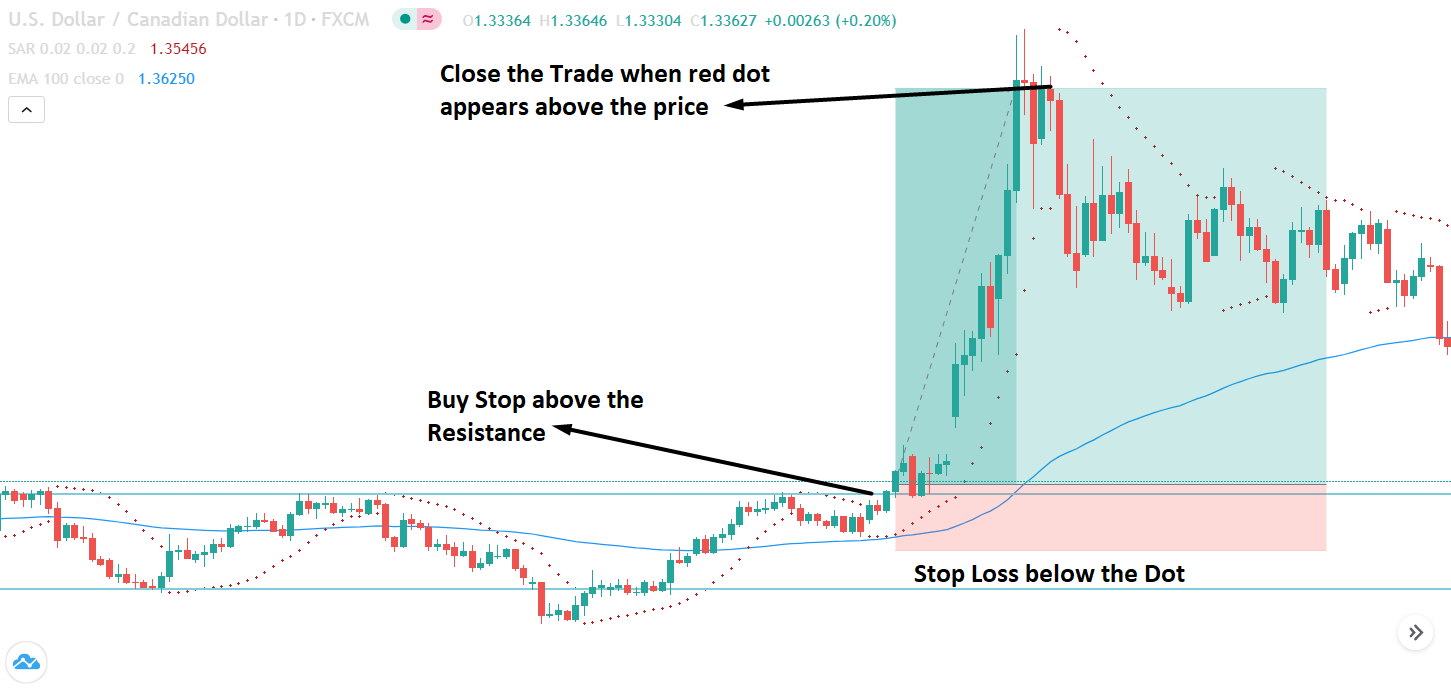

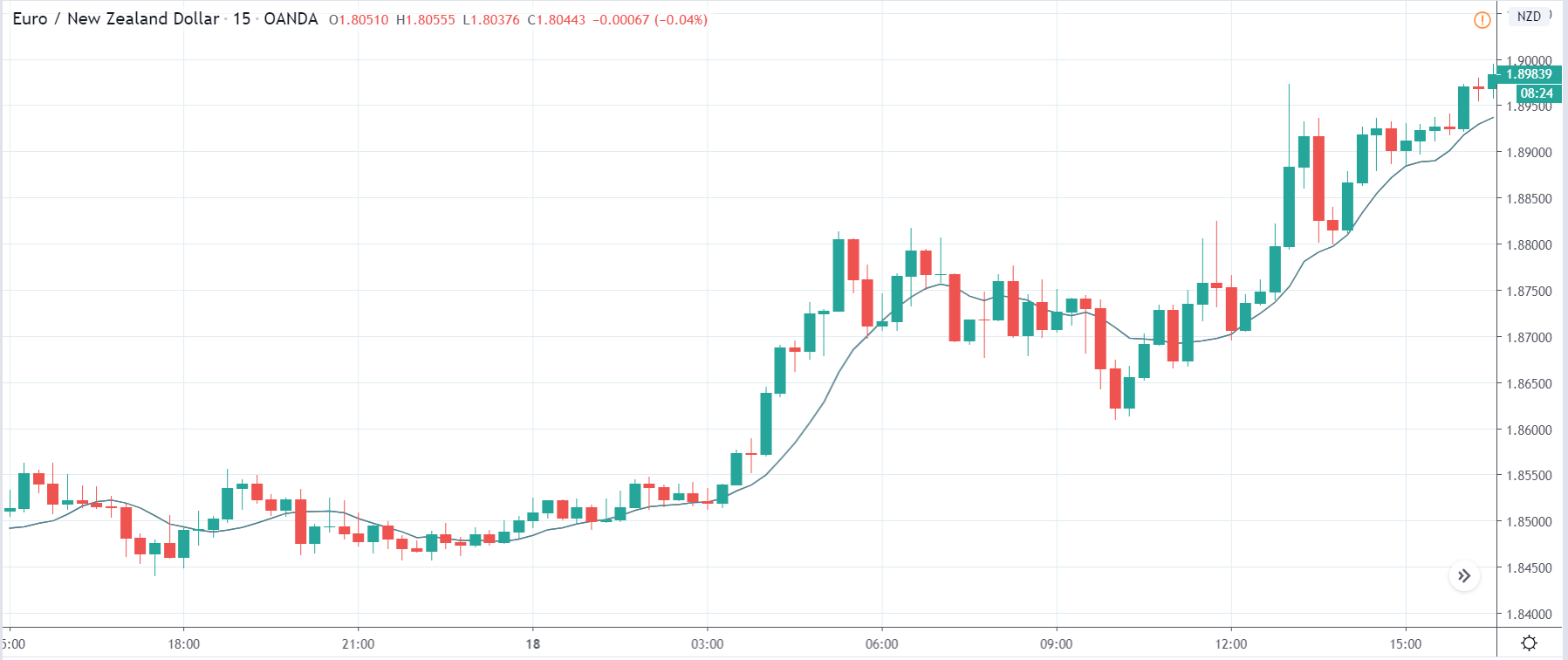

Buy Entry

- First, draw a downward trend line and look for an upward breakout.

- If the breakout has happened, then the price must be residing above the 34 EMA.

- After the downward trend breakout has happened, look at the highs of the bullish candlestick that form.

- The signal candle is the candle with a high that is lower than the last candle’s high. So, if the signal candle’s high is broken, at that point, enter a buy trade immediately. On the other hand, you can put in a buy stop order only a couple of pips over the high of that signal candle so if the price breaks signal candle’s high, your order will be placed.

- If your buy stop order isn’t executed and the candles keep on making lower highs, move your buy stop order to every lower high candle that structures until the price goes up and executes your trade.

- It’s always better to place a stop loss below the downward trend line breakout candle.

Sell Entry

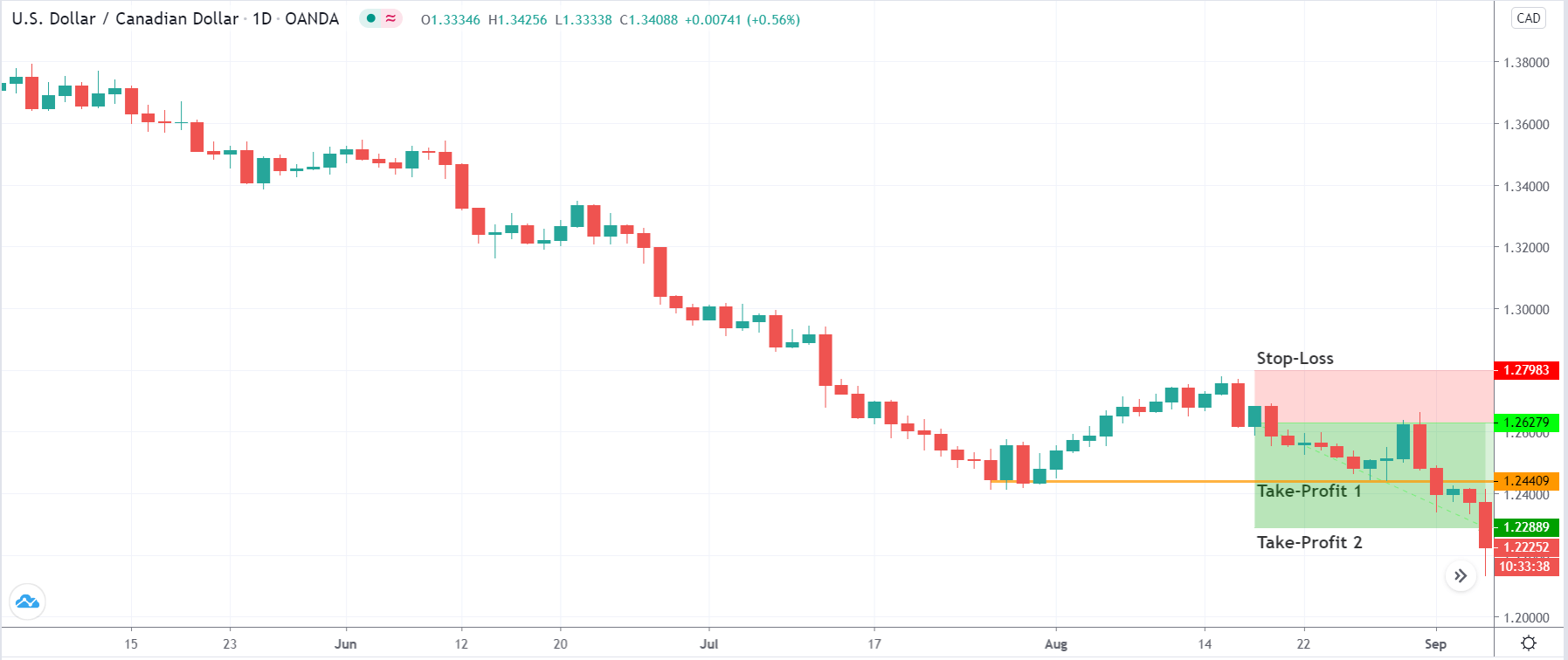

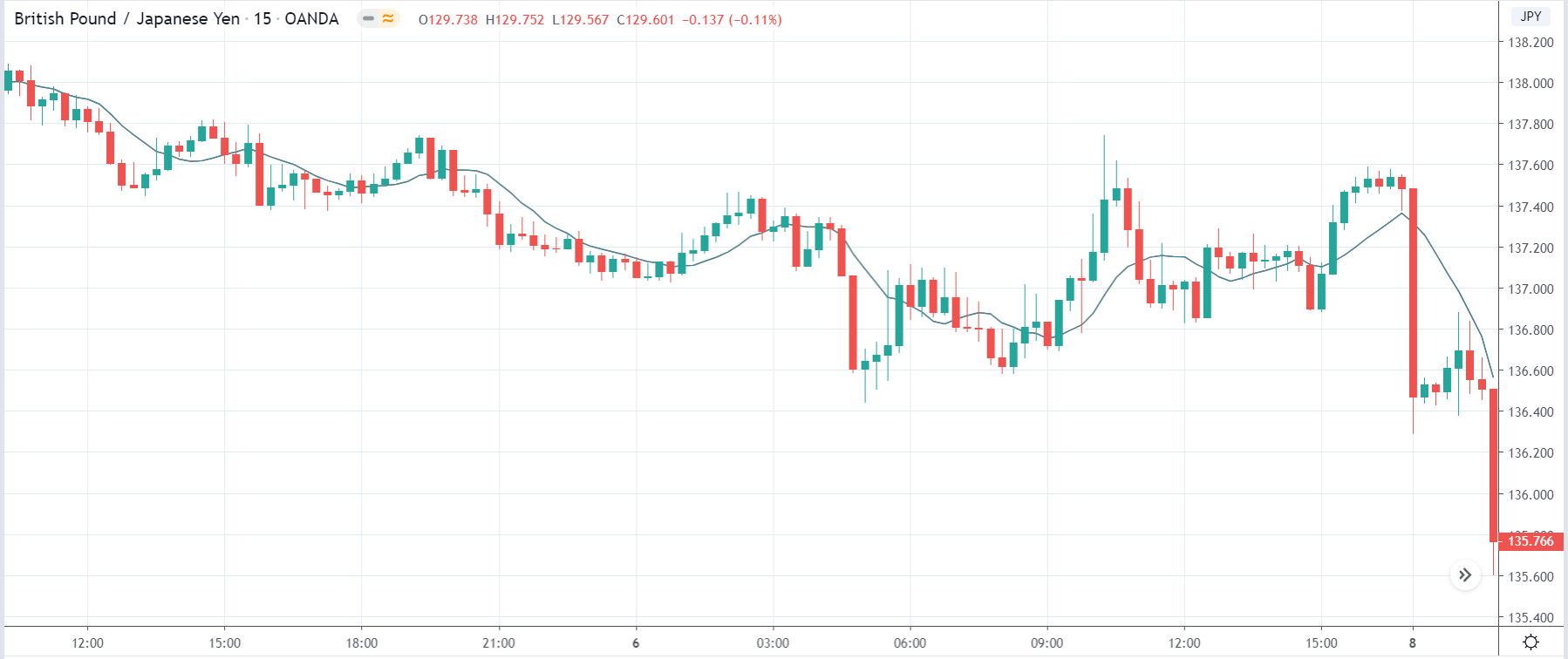

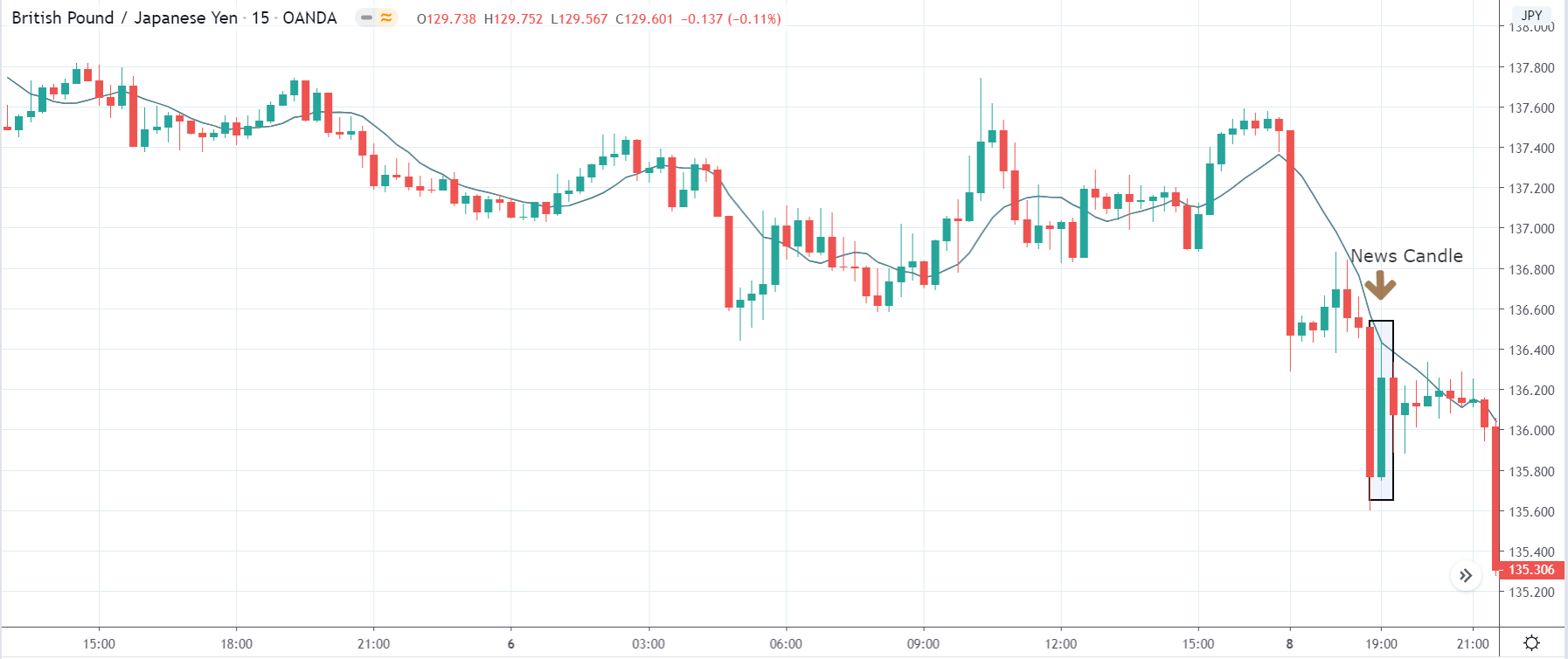

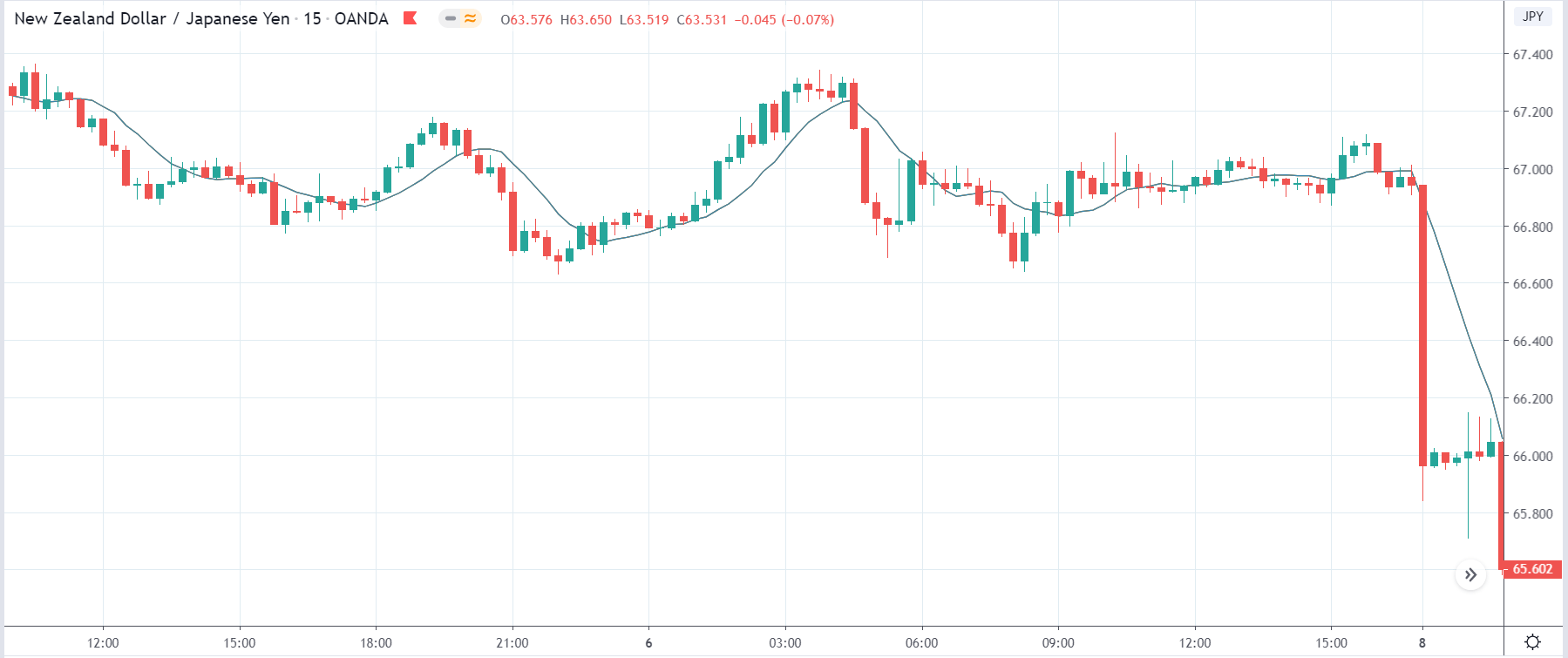

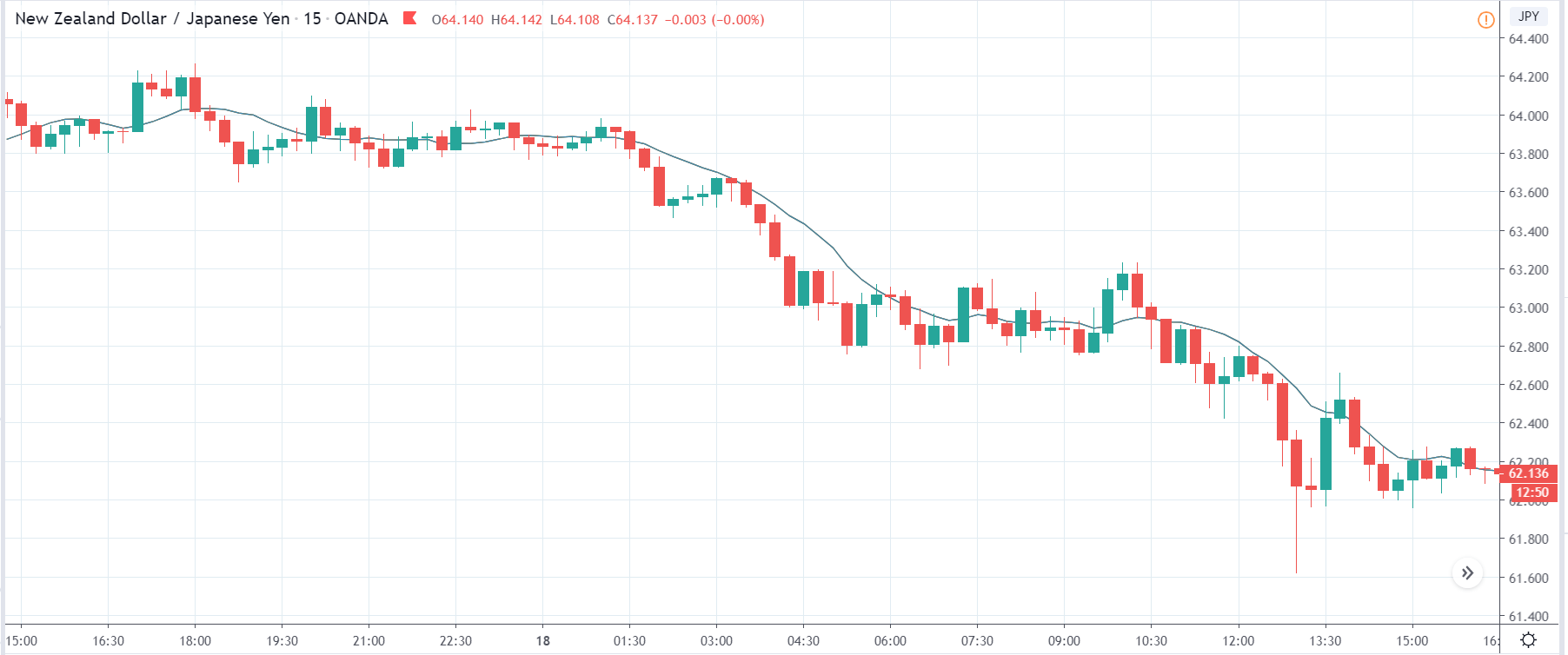

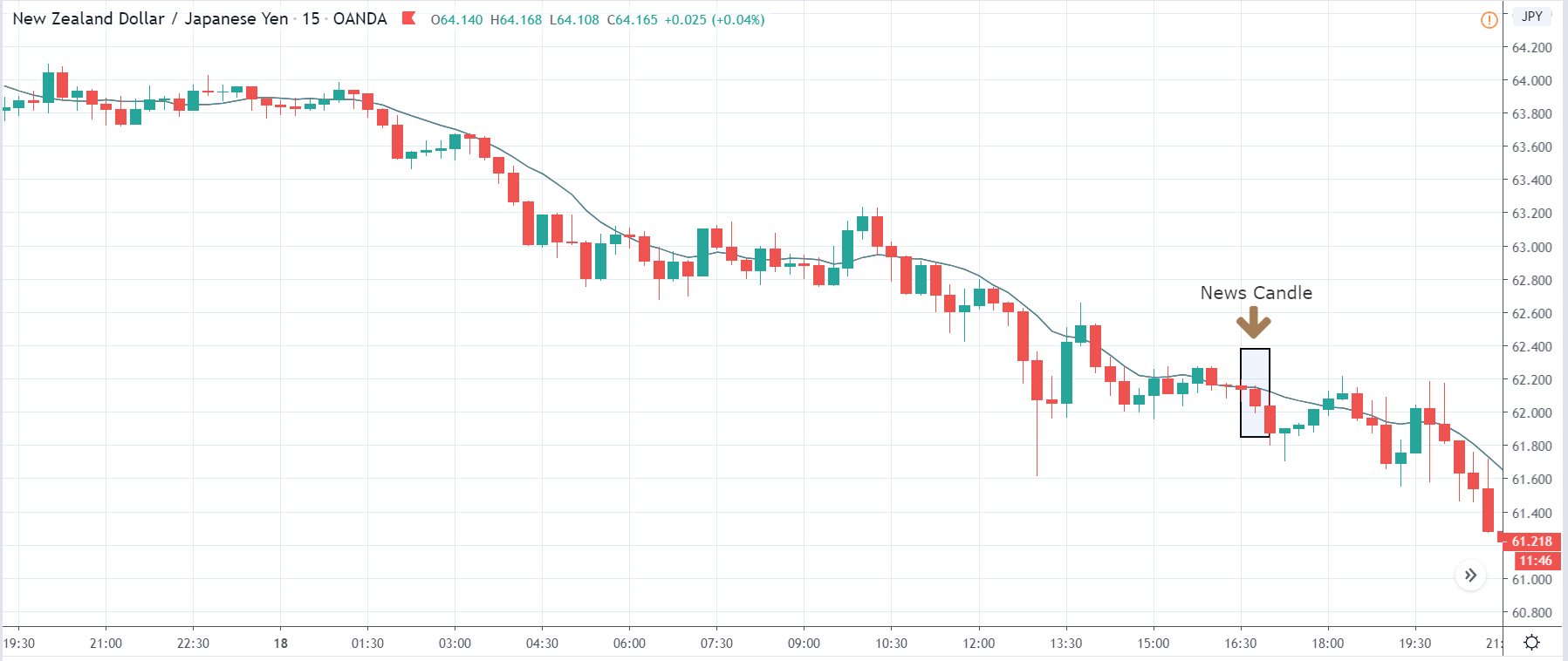

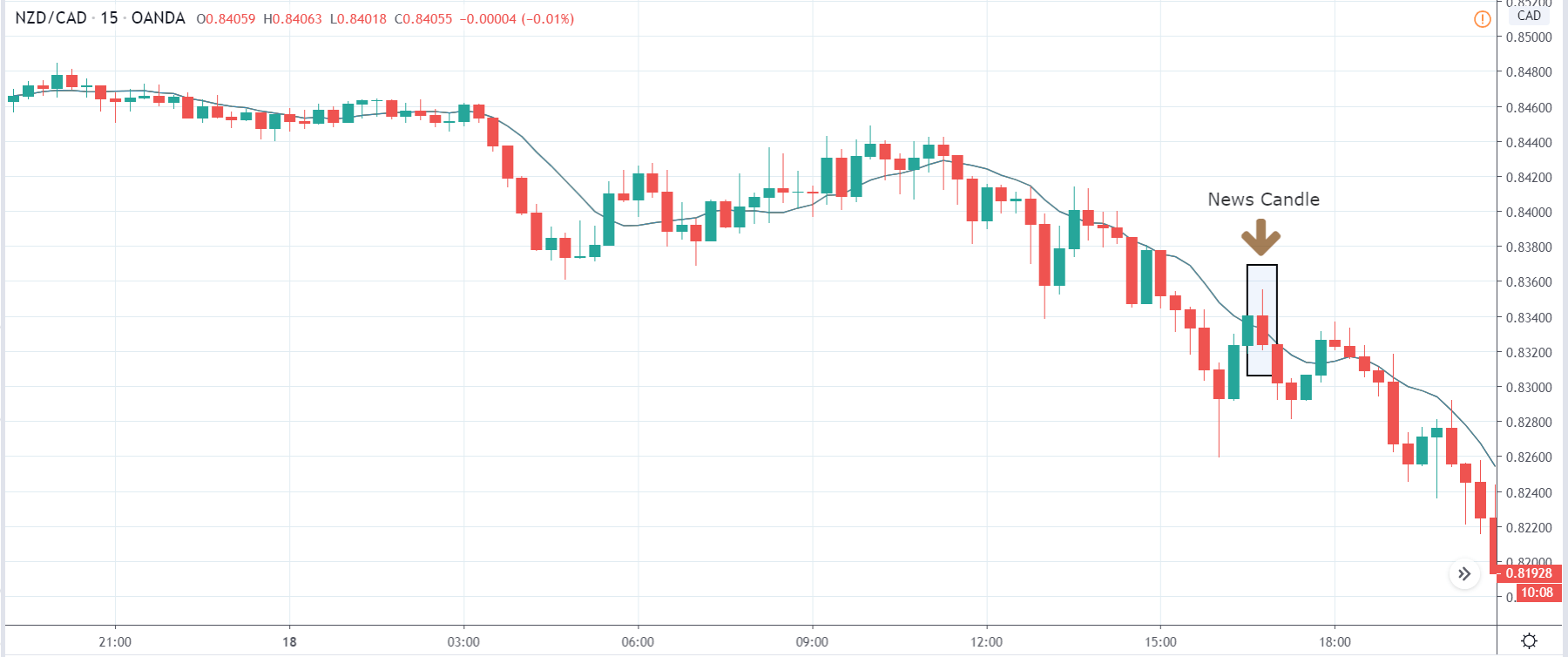

- First, draw an upward trend line and look for a downward breakout.

- If the breakout has happened, then the price must be residing below the 34 EMA.

- After the upward trend breakout has happened, look at the lows of the bearish candlestick that form.

- The signal candle is the candle with a low that is higher than the last candle’s low. So, if the signal candle’s low is broken, at that point, enter a sell trade immediately. On the other hand, you can put in a sell stop order only a couple of pips over the low of that signal candle so if the price breaks signal candle’s low, your order will be placed.

- If your sell stop order isn’t executed and the candles keep on making higher lows, move your sell stop order to every higher low candle that structures until the price goes down and executes your trade.

- It’s always better to place a stop loss above the upward trend line breakout candle.

Limitations of the EMA

It is hazy whether or more emphasis ought to be put on the latest days in the timeframe. Numerous traders accept that new information better mirrors the current pattern of the asset. Simultaneously, others feel that overweighting current dates makes a preference that prompts to more bogus alarms.

Correspondingly, the EMA depends completely on authentic information. Numerous economists suspect that business sectors are proficient, which implies that current market value meanwhile mirrors all accessible data. If the markets are actually proficient, utilising authentic information should disclose to us nothing about the upcoming movement of security prices.

Summary

Let’s summarise the 34 exponential moving average with trendline breakout trading strategy:

- You should look for an impulsive trendline breakout.

- After the trendline breakout has happened, the price must be above or below the 34 EMA (depending on buy and sell entry).

- It’s always better to put the stop loss below or above the trendline breakout candle.

- Better money management can give you a better risk/reward ratio.

Moreover, you need to practice this trading strategy until your win ratio reaches above 60 per cent, and you must have to control your emotion and psychology for better outcomes.

You need to have a good understanding of what your own limits are, this is more in regards to the money that you have available to trade. You often see horror stories of people borrowing money in order to trade, this is never a good idea and is something that you should never do. You need to be able to trade within your own means. In order to work out how much you can trade, think about losing the money that you are wanting to trade with, if it would have a negative effect on your life, such as not being able to do things you would normally do then this is too much, you need to reduce it down to an amount that if you lost, you could still continue to live the way you currently are.

You need to have a good understanding of what your own limits are, this is more in regards to the money that you have available to trade. You often see horror stories of people borrowing money in order to trade, this is never a good idea and is something that you should never do. You need to be able to trade within your own means. In order to work out how much you can trade, think about losing the money that you are wanting to trade with, if it would have a negative effect on your life, such as not being able to do things you would normally do then this is too much, you need to reduce it down to an amount that if you lost, you could still continue to live the way you currently are.

Before we look at the reasons why you possibly should change your strategy, create your own and what you put into it, because if you missed out one or more of these things then you may just need to alter your own rather than look for an entirely new one. Did you take your time to play it? Including risk management, your

Before we look at the reasons why you possibly should change your strategy, create your own and what you put into it, because if you missed out one or more of these things then you may just need to alter your own rather than look for an entirely new one. Did you take your time to play it? Including risk management, your

A lot of new traders are now coming into trading with the hope of not actually putting in the work, so they look to signal providers or a so-called mentor in order to get some trading signals. The problem with this is that they do not give you an understanding of why the trades are being made, this means that you are trading them completely blind, with no knowledge of the risks behind them. The majority of these

A lot of new traders are now coming into trading with the hope of not actually putting in the work, so they look to signal providers or a so-called mentor in order to get some trading signals. The problem with this is that they do not give you an understanding of why the trades are being made, this means that you are trading them completely blind, with no knowledge of the risks behind them. The majority of these

Another reason that we have heard from people is that forex is too complex and overwhelming to learn. Surely that forex is not an overnight thing to learn but there are tons of online material out there that is easily accessible and completely free. Forex is around 4 trillion dollars a day market that traders are trying to go in and extract money from over and over so there could be a lot of benefit for those who are persistent and want to build a career in trading. Honestly, the worst thing is not doing anything. The biggest risk we can ever take is simply not taking any. Why? Because we could end up with no retirement money. Most people have absolutely nothing saved. Relying on someone always and all the time might not be the safest house for us, nobody wants that.

Another reason that we have heard from people is that forex is too complex and overwhelming to learn. Surely that forex is not an overnight thing to learn but there are tons of online material out there that is easily accessible and completely free. Forex is around 4 trillion dollars a day market that traders are trying to go in and extract money from over and over so there could be a lot of benefit for those who are persistent and want to build a career in trading. Honestly, the worst thing is not doing anything. The biggest risk we can ever take is simply not taking any. Why? Because we could end up with no retirement money. Most people have absolutely nothing saved. Relying on someone always and all the time might not be the safest house for us, nobody wants that.

In short, it needs to tell you whether there is enough volume to trade. Think of it as a stoplight. If it’s green (and all your other trade signals align), go ahead and enter the trade. If it’s red, however, that’s your cue to pull out of the trade. A good volume indicator will do both of these things. Another thing to keep an eye on is indicator lag. Some lag is inevitable – all indicators lag to a greater or lesser extent – but you don’t want your volume indicator to lag too much so watch out for that when searching for and testing volume indicators.

In short, it needs to tell you whether there is enough volume to trade. Think of it as a stoplight. If it’s green (and all your other trade signals align), go ahead and enter the trade. If it’s red, however, that’s your cue to pull out of the trade. A good volume indicator will do both of these things. Another thing to keep an eye on is indicator lag. Some lag is inevitable – all indicators lag to a greater or lesser extent – but you don’t want your volume indicator to lag too much so watch out for that when searching for and testing volume indicators.