How do public holidays affect the Forex market?

Thank you for joining the forex academy educational video. In this video presentation, we will be looking at how public holidays affect the forex market.

Public holidays have various effects on the financial markets, including forex trading. For example, in institutional forex trading where banks, hedge funds, and institutions physically buy and sell currencies, which have to be delivered into bank accounts, in some situations, public holidays may require that settlement dates are postponed for one business day.

But in the world of retail currency trading, where traders trade contracts for difference or spread betting, this, of course, does not apply.

Bank holidays mean that the banks in the country where the holiday is taking place will be very unlikely to be trading in the forex market. And because banks are the biggest single participants in the forex markets, if they are on holiday, then the volume of transactions is typically reduced. When volume is reduced, this can have the effect of making the market static in the given currency pair are involved. But this thinning can also cause voids and gaps, which can also have the effect of creating spikes in price action.

As an example, when the Japanese have a public holiday, it is not unusual to see the USD JPY pair have periods of extra and volatility. While, if for example, the Euro area and the US shared a public holiday, such as the Christmas period, you would typically find thin market conditions and little volatility, especially when those two currencies are paired.

Another thing to consider, which most retail traders do not, is that there can often be extra volatility in price action in the 24 or 48 hours before a public holiday, and also so a day or two after a public holiday. This is known as the public holiday effect and is well-known, particularly in the stock market, where investors see extra volatility and usually extra buying during the run-up to public holidays.

Sometimes this is not quite so evident within the forex market; however, things to be considered are that large institutions do not like large exposed trading positions over weekends and public holidays. Often you will find that banks, institutions, and traders like to adjust positions by closing them out or switching between assets, for example, out of a currency and into a more stable asset such as gold, which is very bullish in the current market. This is known as hedging. Certainly, the longer the public holiday, the more likely you will see thinning in markets and where Christmas is the best example.

This type of situation can lead to extra price volatility in the run-up to public holidays, and you should bear this in mind before you place trades before, during, and after a public holiday.

And so, bank holidays can cause the forex market, on occasion, to act erratically and where fundamental and technical analysis sometimes has little or no bearing on price action. In other words, trade during public holidays at your peril. If you insist on trading during these periods, you should expect the unexpected and always maintain tight stop losses. And take note, the bigger the country, the less the volume going through, for example, the most widely traded currency in the United States dollar and if they are on holiday volume crashes, similarly with Europe with regard to the Euro currency.

Ensure that you have a good public holiday calendar which you can refer to in order to trade around public holidays

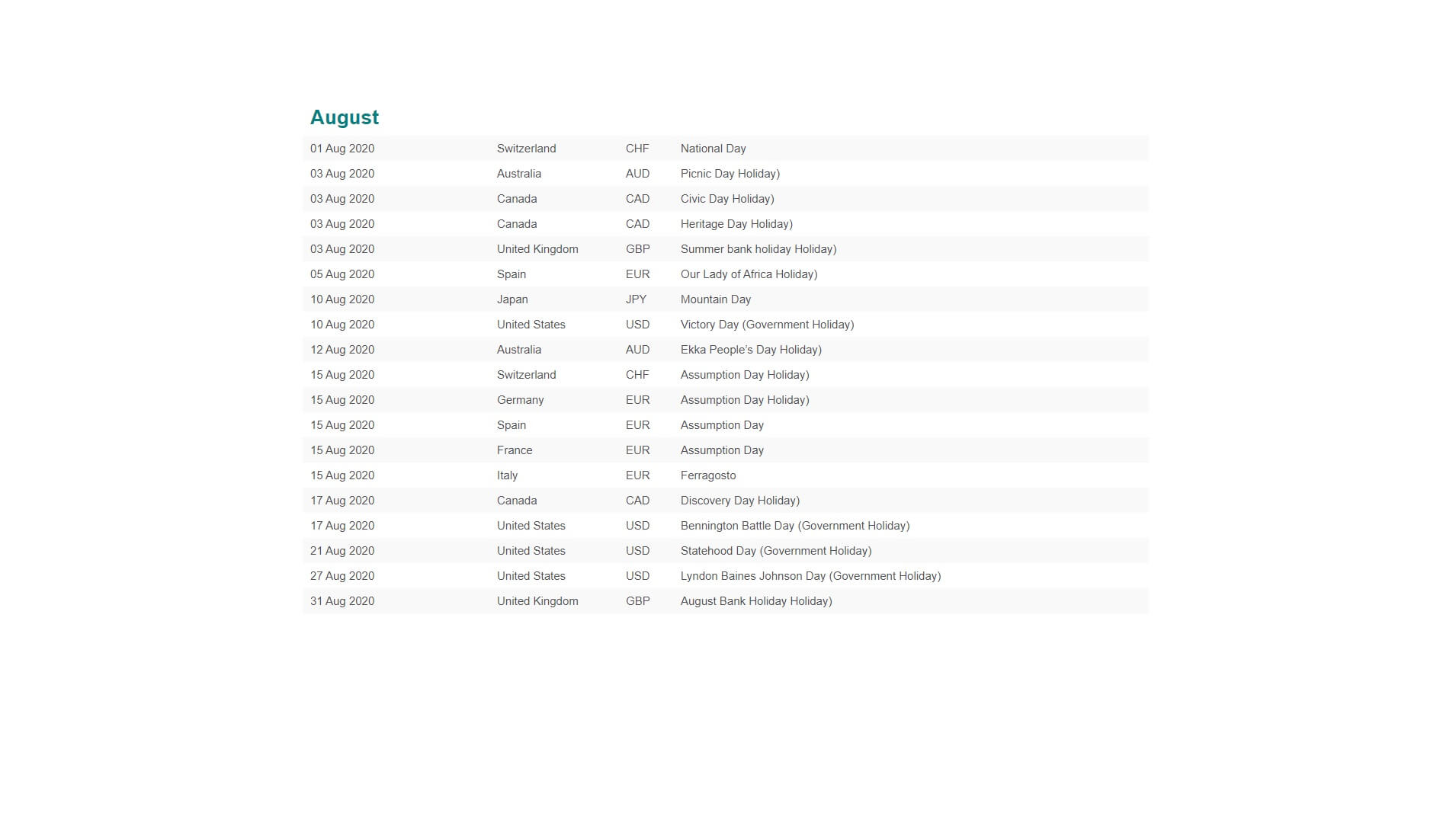

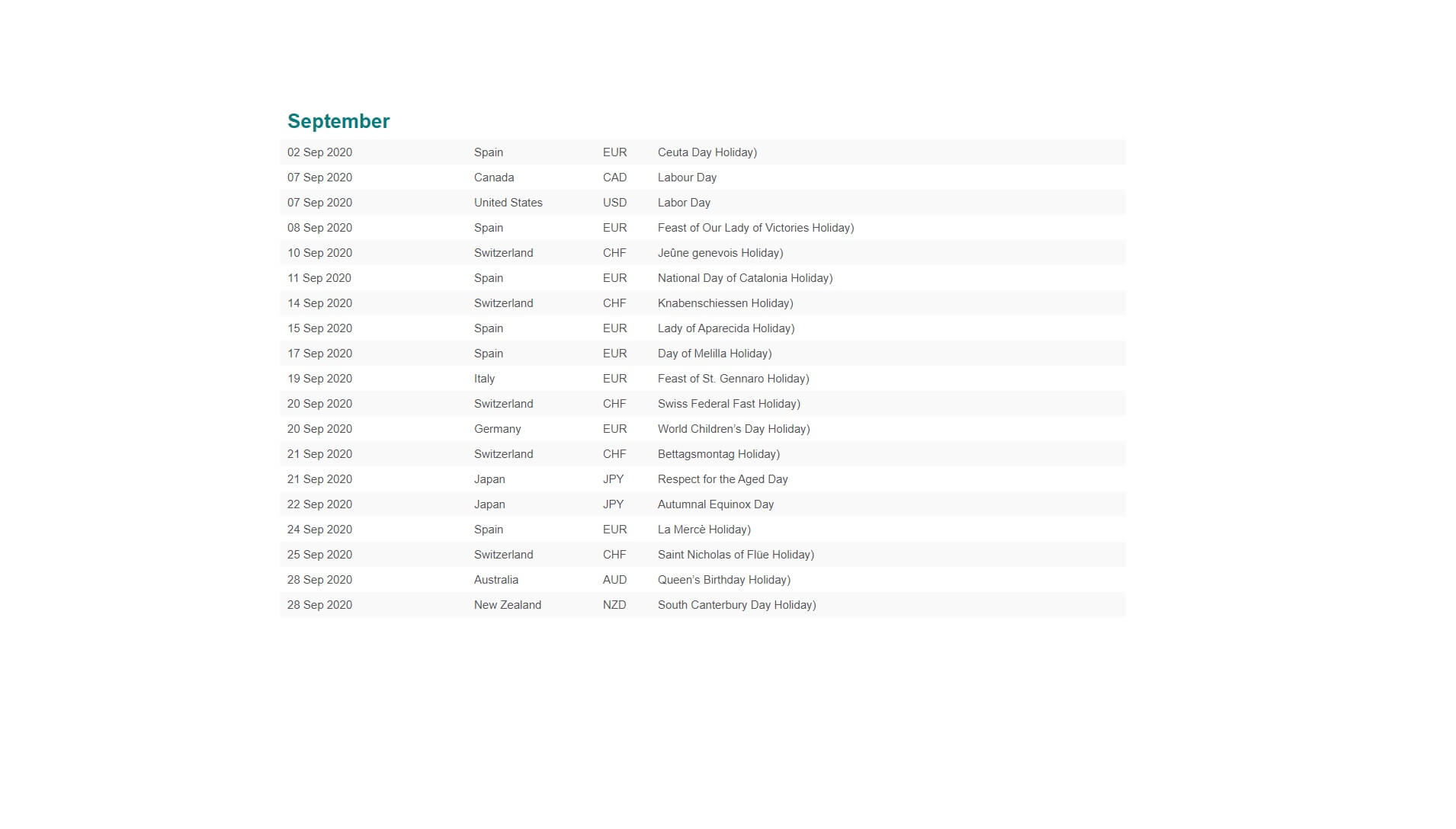

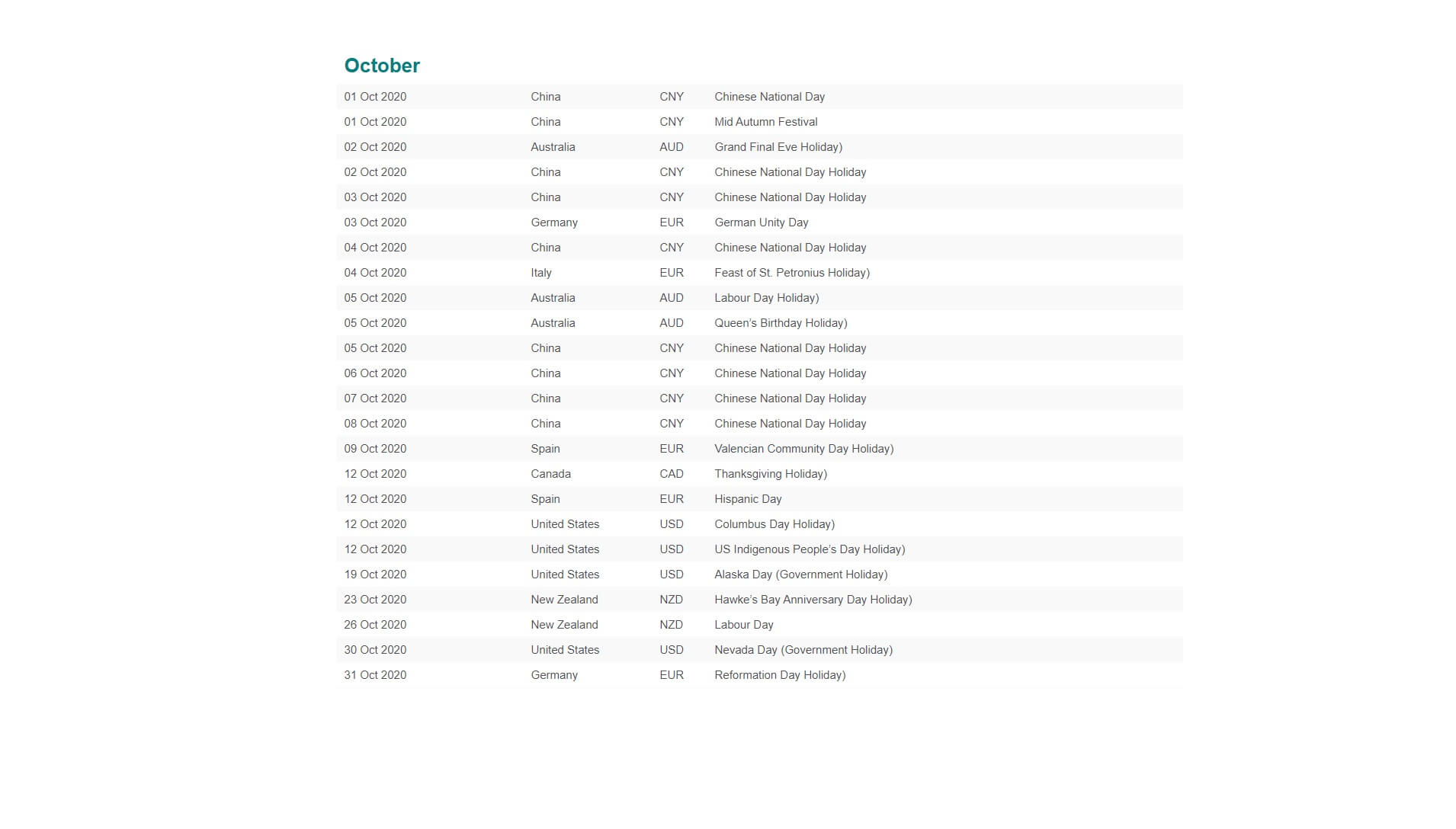

Here are the public holidays for August, September, and October 2020.